Key occasions

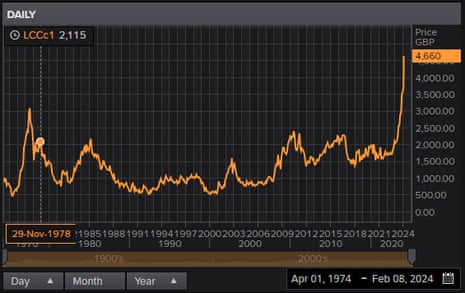

Cocoa value at file highs

Unhealthy climate in West Africa have pushed cocoa costs to file highs this week

Benchmark London cocoa futures hit a file £4,670 a metric ton yesterday, up over 7% – and have roughly doubled because the begin of final yr.

West Africa is house to a few quarters of the world’s manufacturing, however its cocoa crop has been hit by robust Harmattan winds – very dry and powerful winds which blow from the Sahara area in the direction of the West of Africa.

Final night time, chocolate maker Hershey warned that ‘historic’ cocoa inflation might push costs greater.

Hershey’s CEO Michele Buck instructed analysts:

“We are able to’t speak about future pricing [but] given the place cocoa costs are, we shall be utilizing each software in our toolbox, together with pricing, as a solution to handle the enterprise.”

Housebuilder Bellway: Reservations up as mortgage charges fall

UK housebuilder Bellway has reported that falling mortgate charges has spurred demand.

It instructed the Metropolis this morning that reservations in January had been greater than a yr in the past:

The discount in mortgage rates of interest all through the primary half has led to encouraging ranges of buyer enquiries within the historically quieter winter buying and selling interval, and an enchancment within the non-public reservation charge throughout January to 0.59 per outlet per week (January 2023 – 0.45).

Bellway additionally reported a 28% drop in housing completions within the six months to the top of January, to 4,092 properties. This knocked its revenues right down to £1.25bn, from £1.8bn a yr earlier.

The corporate says it’s on monitor to construct 7,500 properties this monetary yr (to the top of July), down from nearly 11,000 within the 12 months to 31 July 2023, including:

The financial outlook has improved by means of the interval, though the Board is aware of future dangers to buyer demand and price inflation, significantly from ongoing geopolitical tensions. Towards this backdrop, we are going to retain a transparent concentrate on sustaining stability sheet resilience.

Rising power costs danger complicating the Financial institution of England’s journey in the direction of slicing rates of interest.

The value of Brent crude has climbed from $77.33 a barrel final Friday night time to $81.50 this morning, in per week during which Israel rejected the phrases of a ceasefire in Gaza proposed by Hamas, insisting victory was “inside attain”

January’s UK inflation report, due subsequent Wednesday, will affect how quickly the Financial institution of England may begin to lower rates of interest.

The annual client costs index is anticipated to have risen barely final month, studies Sanjay Raja, Deutsche Financial institution’s chief UK economist:

After headline inflation stunned to the upside in December, we anticipate an extra – albeit marginal – soar in inflationary stress. Headline CPI in January will possible begin the yr at 4.1% y-o-y, lifted largely by constructive base results. Core CPI, we expect, will settle at 5.0% y-o-y – dragged decrease by core items inflation. And we see companies CPI inching greater to six.6% y-o-y. For RPI, we see headline inflation staying put at 5.1% y-o-y.

Dangers to our forecast? Tilted to the upside. Certainly, weight modifications for CPI will add one other layer of complexity to our inflation projections. And given unstable strikes in catering, journey, and bundle holidays on the whole, we might see companies costs are available in just a little stronger than our baseline projections.

Jonathan Haskel additionally identified that the UK has suffered a sequence of shocks since he joined the BoE in 2018:

“I assume the second factor is … it’s been a turbulent six years and numerous ups and downs and Brexit, (the pandemic), Liz Truss and all that form of factor. I’ve acquired to say the financial system, in some methods, has been amazingly resilient.

“Relative to that magnitude of shocks, we’ve navigated our manner by means of all of this.”

Introduction: Financial institution of England’s Haskel desires extra proof that inflation dangers are waning

Good morning, and welcome to our rolling protection of enterprise, the monetary markets and the world financial system.

Every week on from leaving UK rates of interest on maintain, Financial institution of England policymakers have been scrambling to elucidate their votes, and trace what may make them change their thoughts.

And this morning Jonathan Haskel, one in every of two Financial Coverage Committee members who voted to lift charges final week, has mentioned he desires to seee extra proof that inflationary pressures are cooling.

In an interview with Reuters, Haskel says:

“The indicators that we’ve seen up to now are encouraging. I don’t suppose we’ve seen fairly sufficient indicators but.

But when we accumulate extra proof on persistence, then by the very logic I’ve simply set out, I’d be completely happy to vary my vote.”

Haskel revealed that his vote final week, to lift rates of interest to five.25%, was “finely balanced” – maybe an indication that he might soften his place, if inflation pressures softened first.

However he insisted it was proper to fret about inflation changing into embedded, telling Reuters:

“I’m not going to apologise for banging on about persistence as a result of I believe we’re proper to.”

The BoE left charges on maintain at 5.25% in a uncommon three-way break up, with six policymakers voting for no change, and one – Swati Dhingra – pushing for a lower.

Haskel’s fellow hawk, Catherine Mann, revealed yesterday that her vote was “finely balanced” , but in addition cited dangers of “continued inflation momentum and embedded persistence”.

Mann additionally warned that assaults on cargo ships within the Crimson Sea might create an “upward inflation shock”, driving up items costs – and that means companies inflation – notoriously sticky – would want to fall additional earlier than charges ought to fall.

However excessive rates of interest suppresses exercise and slows the financial system. Earlier this week, Dhingra argued that weak client spending and declining inflation means the Financial institution ought to have lower charges final week.

The Financial institution forecast that inflation will drop to its 2% goal this spring, down from 4% in December, however will rise once more later this yr.

The Metropolis expects at the very least three rate of interest cuts this yr, bringing Financial institution charge right down to 4.5% by the top of 2024.

The agenda

7am GMT: German inflation report for January

9am GMT: Italian industrial manufacturing report for December

4pm GMT: Russia’s GDP report for December