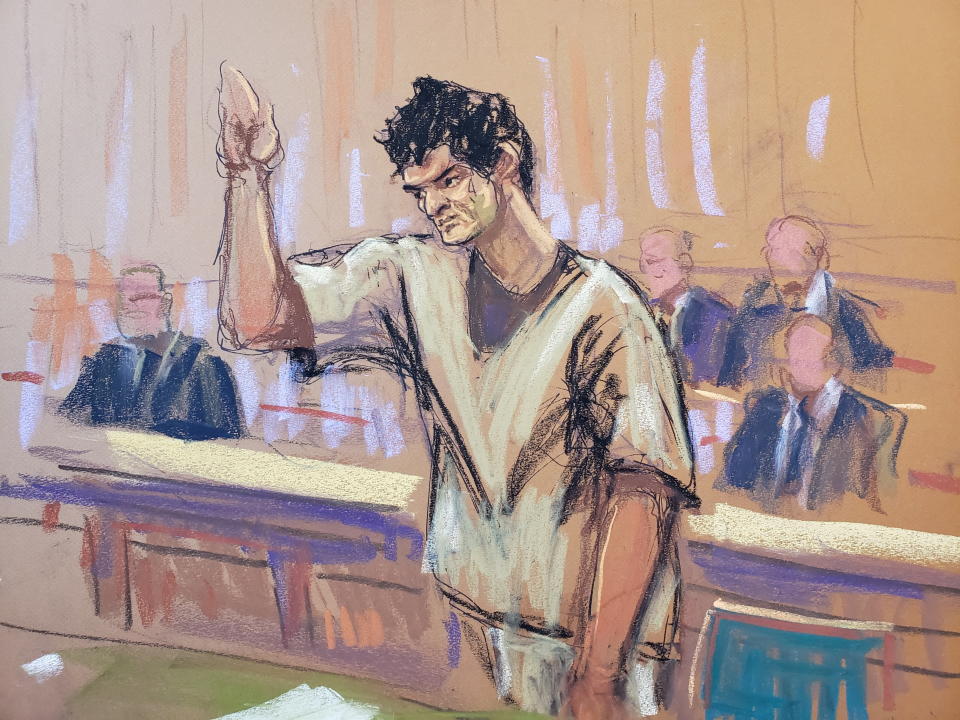

FTX co-founder Sam Bankman-Fried will be taught Thursday how a lot jail time he’ll get after being convicted of defrauding his clients, buyers, and lenders.

The entrepreneur who presided over the most important crypto collapse in historical past faces as much as 110 years. Prosecutors have requested a sentence of 40 to 50 years, whereas Bankman-Fried’s legal professionals requested for six and a half years.

The choice shall be made by Manhattan federal Decide Lewis Kaplan, who presided over Bankman-Fried’s trial final fall and confronted the defendant at a number of factors alongside the way in which.

Kaplan even revoked Bankman-Fried’s bail and put him behind bars earlier than the trial started. Throughout the trial, the choose repeatedly admonished Bankman-Fried on the stand for in a roundabout way answering questions.

Dozens of FTX victims, together with those that stated they misplaced their life’s financial savings as a consequence of FTX’s demise, have submitted letters urging Kaplan to impose a harsh sentence.

Bankman-Fried has made his personal case for a extra lenient sentence, saying in submissions to the courtroom that prosecutors distorted actuality by characterizing him as a “wicked super-villain” motivated by materials wealth and luxuries.

As an alternative, his legal professionals argue in a courtroom submitting, Bankman-Fried “eschews materialistic trappings” and suffers from a extreme situation that causes his “near-complete absence of enjoyment, motivation, and curiosity.”

The legal professionals went on to say that Bankman-Fried has been identified with autism spectrum dysfunction that causes him, at occasions, to evaluate danger with a “completely different relative valuation of feelings versus final influence than many individuals do.”

Bankman-Fried can have yet one more likelihood in courtroom Thursday to make a final assertion, or “allocution.”

Sentences for white collar crimes have different lately, from 150 years for Bernard Madoff to 11 years for Elizabeth Holmes.

Rise and fall

The sentencing of Bankman-Fried completes a dramatic fall for a onetime billionaire who ran the world’s second-largest crypto alternate and was the face of a growth in digital property through the early years of the pandemic.

Story continues

His empire imploded in late 2022 as FTX filed for chapter and he was arrested by authorities within the Bahamas.

His trial final fall captivated the monetary world. A 12-person jury finally sided with prosecutors who argued that Bankman-Fried intentionally stole as much as $14 billion in buyer deposits from his cryptocurrency alternate in a scheme that he carried out with three of his prime executives.

The group, prosecutors claimed, allowed Bankman-Fried’s sister crypto buying and selling agency Alameda Analysis “secret” backdoor entry to FTX’s buyer deposits, then spent the cash on investments, mortgage repayments, political donations, and actual property.

“He spent his clients’ cash, and he lied to them about it,” prosecutor Nicolas Roos stated within the authorities’s closing argument.

The opposite three FTX executives — Alameda CEO Caroline Ellison, FTX co-founder Gary Wang, and FTX engineering director Nishad Singh — pleaded responsible to fraud fees and testified towards Bankman-Fried underneath plea agreements with the federal government.

They’re anticipated to be sentenced later in 2024.

Bankman-Fried testified that poor enterprise selections and administration screwups — and never fraud — had been accountable for the undoing of his cryptocurrency alternate.

“Did you defraud anybody?” Bankman-Fried’s lawyer, Mark Cohen, requested him through the defendant’s dangerous gamble to take the stand within the trial’s remaining days.

“No, I didn’t,” Bankman-Fried answered.

‘The magnitude of the loss is sufficiently nice’

Martin Auerbach, a white collar prison protection legal professional and former federal prosecutor, instructed Yahoo Finance in November that the problem for Bankman-Fried in his sentencing is that “the magnitude of the loss is sufficiently nice.”

The federal sentencing tips, whereas advisory slightly than obligatory, recommend jail time period enhancements that lengthen sentences as victims’ losses enhance. The calculation, Auerbach stated, is a vital think about white collar crimes.

“He in all probability tops out on the charts,” Auerbach stated, referring to between $10 billion and $14 billion that prosecutors stated Bankman-Fried stole from his FTX clients, lenders, and collectors.

The choose “may effectively assume that it is a message that must be stated, not solely to this particular person, however to a era.”

Decide Kaplan shall be tasked with weighing these billions in funds that Bankman-Fried put in danger towards the fact that the corporate now stories those that had been harmed could also be absolutely repaid.

In January, legal professionals for the defunct alternate instructed a Delaware chapter courtroom choose {that a} plan for FTX to repay clients and common unsecured collectors in full was “inside attain.”

“The $8 billion determine for patrons that the federal government makes use of doesn’t replicate buyer losses as of the chapter petition date,” Bankman-Fried’s legal professionals wrote in a pre-sentencing transient.

“It displays the momentary shortfall in liquid property to cowl the unprecedented stage of buyer withdrawal requests starting on November 6, 2022, which reached $4 billion per day the morning of November 8, 2022.”

Bankman-Fried’s legal professionals argue that prosecutors misrepresented at trial that these buyer funds merely vanished.

It doesn’t matter what occurs Thursday, prosecutors have already determined to spare Bankman-Fried from extra authorized jeopardy.

They withdrew plans to take a separate set of fees to trial towards the entrepreneur that alleged he dedicated financial institution fraud and bribed Chinese language officers.

Alexis Keenan is a authorized reporter for Yahoo Finance. Comply with Alexis on Twitter @alexiskweed.

Click on right here for the newest crypto information, updates, and extra associated to ethereum and bitcoin costs, crypto ETFs, and market implications for cryptocurrencies

Learn the newest monetary and enterprise information from Yahoo Finance