Delicate UK inflation helps rate of interest cuts in Might, say economists

UK inflation has remained unchanged at 4%, stunning economists who had predicted a small enhance to 4.2%.

The figures confirmed the primary month-to-month fall in meals costs for greater than two years. Meals and non-alcoholic drink costs fell at a month-to-month charge of 0.4% in January, the primary month-to-month decline since Might 2021, pushed by value cuts in January for bread and cereals, cream crackers, sponge cake and chocolate biscuits. Furnishings and family items costs additionally fell.

That offset the rise in fuel and electrical energy prices after the Nice British power regulator raised its value cap.

You’ll be able to learn our full report right here:

The lower-than-expected determine provides some aid to the Financial institution of England, which is predicted to start out a cycle of rate of interest cuts within the coming months. It means that inflation is on a downward trajectory.

Samuel Tombs, chief UK economist at Pantheon Macroeconomics, a consultancy, stated:

Wanting forward, it stays possible that the headline charge of CPI inflation will fall again to about 2.0% in April after which modestly undershoot the two% goal over the next six months.

He cites some key components forward for the UK. Nice Britain’s power regulator Ofgem is predicted to chop the power value cap by about 15% in April. The federal government will in all probability freeze gas obligation, because it has finished for a decade. And meals value inflation is predicted to stay low as properly.

Tombs expects this to influence the Financial institution of England’s rate-setting financial coverage committee (MPC) that rates of interest can fall within the coming months:

We proceed to assume that CPI outturns over the approaching months will persuade the MPC within the second quarter that financial coverage doesn’t must be fairly as “restrictive” as it’s at the moment, although it seems to be like a toss-up whether or not the committee will choose to chop financial institution charge for the primary time in Might or June.

Martin Beck, chief financial advisor to the EY Merchandise Membership, an financial forecaster, stated:

The EY Merchandise Membership continues to assume that CPI inflation ought to fall to, and maybe even under, the Financial institution of England’s 2% goal over the following few months. Decrease wholesale fuel costs imply power payments are on target to fall by round 15% in April when the Ofgem cap, which governs the standard family power invoice, is recalculated. And if the latest decline in fuel costs (which are actually properly under ranges simply previous to Russia’s invasion of Ukraine) is maintained, one other double-digit proportion fall in payments might be on the playing cards for July.

Disruption to transport on account of geopolitical tensions presents a possible danger to inflation’s descent. However with transport prices solely a tiny a part of the worth shoppers pay for items, that inflationary danger seems to be modest at current. Total, the newest inflation information ought to reassure the MPC that the time to start out chopping rates of interest is approaching. The EY Merchandise Membership continues to count on the primary lower in financial institution charge in Might.

Key occasions

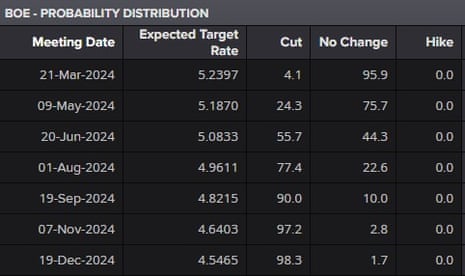

Let’s check out what monetary markets are saying on the prospects for UK rates of interest.

The under desk exhibits the probability of rate of interest strikes at every assembly of the Financial institution of England’s financial coverage committee – in response to the bets of monetary merchants. It exhibits that in Might merchants assume there’s a one-in-four likelihood of a charge lower.

Nevertheless, in June that rises to a 55.7% likelihood of a charge lower. And by December markets are pricing in virtually three charge cuts.

If the Financial institution goes by means of with three cuts that would go away rates of interest at 4.5% by the top of the yr, down from 5.25% now.

Delicate UK inflation helps rate of interest cuts in Might, say economists

UK inflation has remained unchanged at 4%, stunning economists who had predicted a small enhance to 4.2%.

The figures confirmed the primary month-to-month fall in meals costs for greater than two years. Meals and non-alcoholic drink costs fell at a month-to-month charge of 0.4% in January, the primary month-to-month decline since Might 2021, pushed by value cuts in January for bread and cereals, cream crackers, sponge cake and chocolate biscuits. Furnishings and family items costs additionally fell.

That offset the rise in fuel and electrical energy prices after the Nice British power regulator raised its value cap.

You’ll be able to learn our full report right here:

The lower-than-expected determine provides some aid to the Financial institution of England, which is predicted to start out a cycle of rate of interest cuts within the coming months. It means that inflation is on a downward trajectory.

Samuel Tombs, chief UK economist at Pantheon Macroeconomics, a consultancy, stated:

Wanting forward, it stays possible that the headline charge of CPI inflation will fall again to about 2.0% in April after which modestly undershoot the two% goal over the next six months.

He cites some key components forward for the UK. Nice Britain’s power regulator Ofgem is predicted to chop the power value cap by about 15% in April. The federal government will in all probability freeze gas obligation, because it has finished for a decade. And meals value inflation is predicted to stay low as properly.

Tombs expects this to influence the Financial institution of England’s rate-setting financial coverage committee (MPC) that rates of interest can fall within the coming months:

We proceed to assume that CPI outturns over the approaching months will persuade the MPC within the second quarter that financial coverage doesn’t must be fairly as “restrictive” as it’s at the moment, although it seems to be like a toss-up whether or not the committee will choose to chop financial institution charge for the primary time in Might or June.

Martin Beck, chief financial advisor to the EY Merchandise Membership, an financial forecaster, stated:

The EY Merchandise Membership continues to assume that CPI inflation ought to fall to, and maybe even under, the Financial institution of England’s 2% goal over the following few months. Decrease wholesale fuel costs imply power payments are on target to fall by round 15% in April when the Ofgem cap, which governs the standard family power invoice, is recalculated. And if the latest decline in fuel costs (which are actually properly under ranges simply previous to Russia’s invasion of Ukraine) is maintained, one other double-digit proportion fall in payments might be on the playing cards for July.

Disruption to transport on account of geopolitical tensions presents a possible danger to inflation’s descent. However with transport prices solely a tiny a part of the worth shoppers pay for items, that inflationary danger seems to be modest at current. Total, the newest inflation information ought to reassure the MPC that the time to start out chopping rates of interest is approaching. The EY Merchandise Membership continues to count on the primary lower in financial institution charge in Might.

The FTSE 100 has opened up 0.5%, probably helped by a weaker pound after the inflation information.

London’s blue-chip index has additionally been helped by sturdy figures from Coca-Cola Hellenic Bottling Firm, a distributor of the smooth drink which is up 5% within the opening trades.

Throughout Europe it has been a much less rousing begin to the buying and selling day. Listed below are the opening snap stories on inventory markets, through Reuters:

EUROPE’S STOXX 600 FLAT

FRANCE’S CAC 40 DOWN 0.2%, SPAIN’S IBEX UP 0.2%

EURO STOXX INDEX DOWN 0.1%

EURO ZONE BLUE CHIPS DOWN 0.2%

GERMANY’S DA FLAT

Up to date at 03.10 EST

The weaker pound seems to be serving to prospects for the FTSE 100 firms, which make the majority of their earnings in different currencies.

FTSE 100 futures counsel the index will achieve 0.5% after they open in about quarter-hour’ time.

The Financial institution of England is gearing as much as lower rates of interest. That might typically be anticipated to push up inflation, so Financial institution governor Andrew Bailey can be in a tough place if headline inflation had been rising.

As it’s, monetary markets are trying extra comfy with the concept that a number of cuts in the primary lending charge, financial institution charge, are on the way in which.

UK rate of interest futures present that markets have elevated their bets on charge cuts throughout 2024. They suggest that charges will fall by 0.71 proportion factors throughout 2024, up from 0.58% earlier than the information, in response to Reuters.

Financial institution charge is at 5.25%, so that will counsel practically three rate of interest cuts throughout 2024 (assuming every lower is 0.25 proportion factors).

This can be a aid to the federal government and Financial institution of England

Core inflation was decrease than thought, companies inflation edged up lower than anticipated, and month-to-month value progress was -0.6%, double the forecast drop

£ at a 1-week low – merchants had been braced for a nasty shock after US CPI

— Lizzy Burden (@lizzzburden) February 14, 2024

Jeremy Hunt will not be the one particular person feeling considerably relieved this morning: for the Financial institution of England it should possible forestall criticisms of its financial coverage stance.

The response on monetary markets suggests that could be the case: sterling has dipped by 0.14% in opposition to the US greenback and 0.2% in opposition to the euro. That transfer often suggests a wager on decrease charges (that are much less enticing for traders in a position to transfer their cash everywhere in the world searching for higher returns).

Right here is the graph displaying the transfer in sterling because the lower-than-expected inflation studying got here in:

The political response to the inflation studying has began.

Here’s what chancellor Jeremy Hunt needed to say:

Inflation by no means falls in an ideal straight line, however the plan is working; now we have made big progress in bringing inflation down from 11%, and the Financial institution of England forecast that it’ll fall to round 2% in a matter of months.

Rachel Reeves, Labour’s shadow chancellor, stated:

After 14 years of financial failure working individuals are worse off. Costs are nonetheless rising within the outlets, with the typical households’ prices up £110 every week in comparison with earlier than the final election. Inflation remains to be greater than the Financial institution of England’s goal and thousands and thousands of households are battling the price of dwelling.

The Conservatives can not repair the financial system as a result of they’re the explanation it’s damaged. It’s time for change. Solely Labour has a long-term plan to get Britain’s future again by delivering extra jobs, extra funding and cheaper payments.

We often quote inflation as an annual quantity, however the month-to-month studying additionally suggests the downward trajectory: on a month-to-month foundation, the buyer value index (CPI) fell by 0.6% in January.

The core measure of CPI additionally remained unchanged in January, at 5.1% yearly. And that was decrease than the 5.2% anticipated by economists. The core measure ignores unstable power, meals, alcohol and tobacco to attempt to get a extra correct image of underlying inflationary pressures.

The headline inflation studying helps the interpretation (see opening put up) that value pressures are easing within the UK.

Right here is the ONS’s graph displaying that trajectory, beginning in 2014. Inflation spiked in 2022 after Russia’s full-scale invasion rocked world power markets, earlier than falling again as these will increase light.

Rising power costs – after Nice Britain’s power regulator raised the worth cap – had been the primary motive that inflation stayed at 4%, in response to the UK’s Workplace for Nationwide Statistics (ONS).

Nevertheless it was furnishings and family items that prevented the anticipated enhance.

It stated:

The most important upward contribution to the month-to-month change in each CPIH and CPI annual charges got here from housing and family companies (principally greater fuel and electrical energy fees), whereas the most important downward contribution got here from furnishings and family items, and meals and non-alcoholic drinks.

Up to date at 02.24 EST

UK inflation stays flat at 4% in January

Newsflash: The UK’s shopper value index (CPI) inflation has stayed flat at 4% in January – unchanged from December.

Economists had anticipated a small enhance to 4.2%, so it is a softer studying than anticipated.

UK inflation anticipated to rise, say economists

Good morning, and welcome to our dwell, rolling protection of enterprise, economics and monetary markets.

UK inflation has fallen sharply within the final yr as the worldwide power market has calmed down following the chaos attributable to Russia’s full-scale invasion of Ukraine. However inflation could properly have ticked upwards in January: we’ll discover out whether or not that was certainly the case at 7am UK time.

Economists are forecasting a small enhance within the UK’s shopper value index (CPI) in January. A ballot by Reuters of economists means that inflation will rise from 4% in December to 4.2%.

That might be a second consecutive month-to-month enhance, though nonetheless properly down from its 41-year excessive of 11.1% in October 2022. The under chart exhibits the information for the final 5 years as much as December.

Sanjay Raja, senior economist at Deutsche Financial institution, stated:

After headline inflation stunned to the upside in December, we count on an extra – albeit marginal – soar in inflationary stress.

Nevertheless, Raja warns in opposition to getting too excited if inflation does rise as anticipated. The speed might be “lifted largely by constructive base results”, which means that the index was briefly decrease final yr than would in any other case be anticipated. That has partly been attributable to will increase in January to the federal government’s power value cap And manufacturing facility costs tracked by the producer costs index (PPI) are additionally softening, which ought to ultimately be handed by means of to slowing inflation for shoppers.

Raja stated:

Wanting forward, we proceed to see disinflationary pressures construct, per slowing survey and PPI information. We see CPI slowing under 2% year-on-year in [the second quarter of 2024], earlier than edging a little bit above 2% by means of [the second half of 2024].

Wanting forward, we even have the second estimate for eurozone GDP. The primary studying confirmed 0% progress. That’s hardly one thing to write down house about, however it took economists unexpectedly, and meant that the bloc prevented a technical recession.

We might be looking out for any downward revisions for the fourth quarter, which might imply that the eurozone was, in truth, in a technical recession. Downward revision or not, it might hardly change the scenario: Europe’s financial system is stuttering as Germany struggles.

The agenda

7am GMT: UK shopper value index inflation (January; earlier: 4% annual; consensus: 4.2%)

10am GMT: Eurozone GDP progress charge (fourth quarter of 2023; prev.: 0.1% quarter-on-quarter; cons.: 0%)

10am GMT: Eurozone industrial manufacturing (December; prev.: -6.8% year-on-year; cons.: -4.1%)