China’s economic system has lately turn into a topic of widespread concern. The FT has an article with the next headline:

China’s customers tighten belts at the same time as costs fall

The time period “even” caught my consideration. Absolutely the FT editors don’t imagine that falling costs can be anticipated to spice up consumption? That might be an EC101-level error. And but, the article additionally contained this odd declare:

Weak worth development will not be routinely encouraging folks to spend.

“Theoretically low costs ought to enhance buying energy of customers, however that hasn’t been the case,” mentioned Louise Lavatory, lead economist at Oxford Economics. “We expect the reason being as a result of the deflationary mindset has been fairly entrenched.” “I believe that is the beginning of a fairly structural pattern,” she added.

“Folks have turn into much more precautionary . . . They suppose loads more durable about how they need to spend a further greenback of revenue.”

I don’t know what concept Louise Lavatory is referring to, because it’s one I’ve by no means seen. Certainly, this sounds loads like reasoning from a worth change.

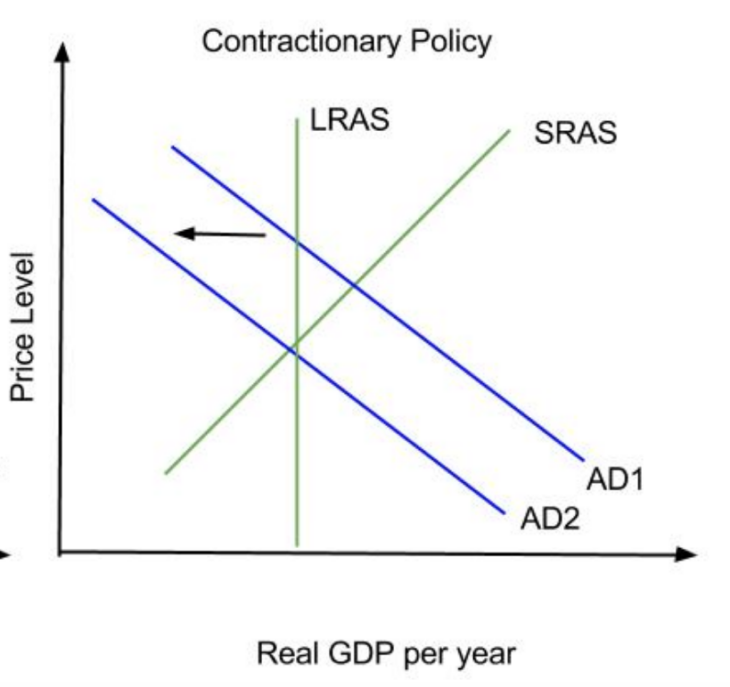

Right here it could be helpful to evaluation the economic system’s round movement, which says that gross spending equals gross output equal gross revenue. Falling costs don’t enhance buying energy, except the autumn in costs is brought on by an increase in combination provide. But when the autumn in costs was brought on by a fall in combination demand, you then’d truly count on a fall in shopper buying energy, as a decline in AD sometimes reduces actual output and actual revenue. By no means purpose from a worth change.

In China’s case, the latest fall in costs is nearly definitely on account of a fall in AD (or extra exactly a slowdown within the development price of AD). We all know this as a result of output development can be pretty weak. This implies that China’s financial coverage is simply too contractionary.

Milton Friedman as soon as mentioned that persistent inflation is all the time and in every single place a financial phenomenon. Right here’s what I’d say:

Excessively tight financial coverage is all the time and in every single place misdiagnosed as another drawback.

This misdiagnosis happens for a number of causes. First, most individuals—even most economists—don’t know as to the best way to consider the stance of financial coverage. To place it bluntly, most economists wouldn’t acknowledge tight cash if it have been proper in entrance of their nostril. Second, most economies that endure from tight cash additionally endure from different issues. Thus the falling costs and weak output are attributed to different features of the economic system, not financial coverage. (Recall when the 2008-09 decline in AD was wrongly blamed on housing and banking issues.)

As an analogy, I lately had two consecutive diseases. At first, I believed the second was my first sickness getting worse. Solely final Wednesday did I am going to the physician and uncover I had diverticulitis (a situation I’d by no means even heard of.) I’ve additionally had colds that morphed into pneumonia. In these circumstances, I didn’t initially see the issue, assuming it was only a “unhealthy chilly”.

This type of error is excusable, as colds do truly make yet another inclined to pneumonia. Equally, numerous “actual issues” with an economic system make it extra doubtless {that a} central financial institution will undertake an excessively contractionary financial coverage. That’s partly as a result of many central banks goal rates of interest, and actual issues often decrease the pure or equilibrium price of curiosity.

Mark Leonard lately interviewed quite a few economists and different coverage specialists in China:

The important query behind all that is how effectively the economic system is definitely doing. Among the many Chinese language economists I put this to, the most typical reply was “very unhealthy.” However they reject the Western evaluation of peak China on account of demographic points, an absence of home reform and a detrimental worldwide surroundings. As an alternative, they level to China’s structural benefits. Of its 1.4 billion residents, solely 400 million are center and excessive revenue. The remaining billion are nonetheless low revenue — a whole lot of tens of millions of them within the countryside — and might nonetheless be introduced into an city industrial economic system, boosting home demand in addition to financial development.

The important thing problem for China is stimulating that demand. China has numerous fiscal head room to do that.

At the very least they perceive that the issue is combination demand, which the FT article doesn’t even focus on. However China wants financial stimulus, not fiscal stimulus.

The Chinese language economists perceive that China has numerous potential, if they’ll get the coverage proper:

The demographic state of affairs will not be the issue that Westerners suppose, they really feel, no less than within the short-term. China will not be desperately in need of employees: there’s 20% unemployment for younger folks, and it’s all the time potential to deliver extra employees in from the countryside. Economists are additionally optimistic about advances in new applied sciences. China is overtaking Japan because the world’s largest automobile exporter this yr, and the Chinese language firm BYD is the world’s greatest producer of electrical automobiles, with gross sales that go away Tesla within the mud), and it’s making progress in AI. Economists at Tsinghua and Peking College informed me they’ve constructed fashions which present that China’s development potential for the following decade is between 5 and 6% yearly, by means of a mix of superior trade upgrades and clear power expertise.

In brief, Chinese language specialists really feel the financial fundamentals are usually not as unhealthy as Western debate suggests. The place they’re actually pessimistic is in regards to the politics. “America can’t cease China’s development,” one economist mentioned, “solely the stupidity of our leaders and the sycophancy of their advisers can do this.”

The whole article is superb—effectively price studying. It’s additionally one of many saddest articles that I’ve learn in years.

HT: David Levey.

PS. The title and subtitle of Leonard’s article caught my eye:

20 years in the past, China’s reformist economists walked the halls of energy and dictated coverage. Now, they’ve been side-lined in favor of a brand new precedence: nationwide safety. What occurred?

Wouldn’t these headlines even be considerably correct:

20 years in the past, America’s reformist economists walked the halls of energy and dictated coverage. Now, they’ve been side-lined in favor of a brand new precedence: nationwide safety. What occurred?

20 years in the past, Russia’s reformist economists walked the halls of energy and dictated coverage. Now, they’ve been side-lined in favor of a brand new precedence: nationwide safety. What occurred?

Sure, what occurred to all the world?

PPS. As an alternative of an article with a whole lot of ambiguous phrases, if solely the FT had given us this graph: